Financial Analysts

The Financial Analyst job is very popular because it contains work in a wide range of industries, allows for future growth, and has high earning potential.

This article looks at Financial Analysts, explaining how to be a Financial Analyst and what Financial Analysts do.

Specifically, we’ll look at:

- What is a Financial Analyst?

-

- Task and duties

- Required skills and education

- Personal attributes required

- Salary

- Is financial analyst the right role for me?

- Steps to becoming a Financial Analyst?

- Financial Analyst interview questions

What is a Financial Analyst?

A Financial Analyst is someone who makes business recommendations (like investment decisions) based on analyses of financial data (like market trends, company status, etc.)

Financial Analysts gather, organise, and analyse financial data. The analysis usually requires making projections of the outcomes of business decisions. Then, based on the predicted outcomes, the Financial Analyst recommends business actions that best serve the organisation’s interests.

Thus, the Financial Analyst job description falls into three broad categories:

- Analyse business data

- Predict the outcome of business decisions

- Make recommendations for the best business action.

Tasks and Duties (what does a Financial Analyst do)

The Financial Analyst may complete the following tasks on a day-to-day basis:

- Perform data mining, market research, and business intelligence

- Identify market trends

- Analyse past results and perform variance analysis

- Analyse financial data

- Evaluate financial performance by comparing actual results with initial forecasts

- Create financial models to support business decisions

- Prepare financial performance reports

- Deploy data query/ data management tools such as Access and SQL in data analysis

- Recommend actions by interpreting data

Required Skills and Education

To be a Financial Analyst, you need at least a college degree in one of the following:

- Finance

- Accounting

- Economics

- Statistics

You also need skills to make it as a Financial Analyst. These include:

- Data gathering skills

- Analytical skills

- Decision-making skills

- Financial modelling skills

- Presentation skills

Personal attributes required

To succeed as a Financial Analyst, you need certain traits in addition to your education and requisite skills. These include:

- A like for dealing with numbers

- Ability to influence and persuade

- Organised

- Self-starter

- Attention to details

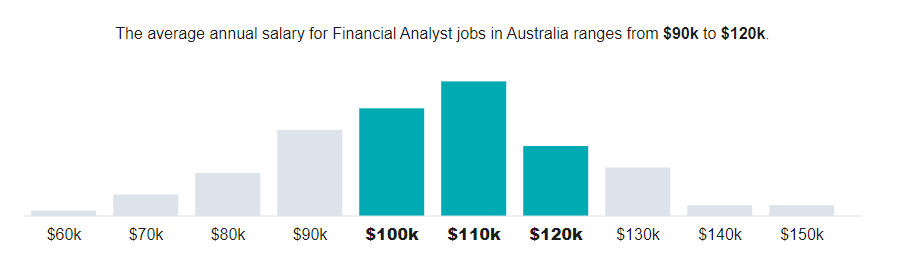

Salary

According to SEEK, the typical salary for a Financial Analyst in Australia is $105,000. However, salaries can range from $60,000 to $150,000.

Is Financial Analyst the right role for me?

If you major in business, finance, or accounting and are detail-oriented, like working with numbers, and are confident in making recommendations based on data, then a Financial Analyst role may be perfect for you.

The US News and World Report rank Financial Analysts #13 in Best Business Jobs.

Type of analyst positions

Financial analysts research companies and industries to help their principals make the best business decisions.

Thus, Financial Analysts are often categorised based on the business decisions that their research will support and the identity of their principals.

That is, the common types of Financial Analysts are investment banking analysts, equity research analysts, treasury analysts, etc.

But in the world of wall street, Financial Analysts are categorised as buy-side analysts and sell-side analysts according to whether their principals buy or sell financial securities.

Buy-Side Analysis

The buy-side analysts work for investors with money to buy securities like shares, bonds, derivatives, etc. The buy-side analysts manage their client’s money, perform financial modelling and valuation, do research on investment opportunities, make investment decisions, and grow assets.

Typical buy-side analysis jobs include:

- Portfolio management

- Wealth management

- Hedge funds management

- Private equity

Skills and attributes you need for buy-side analysis include:

- Excel skills

- Industry research

- Financial modelling

- Generating research reports

Sell-Side Analysis

Sell-side analysts work for firms that need to raise money by selling securities. They perform financial modelling and valuation, raise debt and equity capital, advise on mergers and acquisitions, market and sell securities, create liquidity for listed securities, etc.

Typical sell-side analysis jobs include:

- Commercial and corporate baking

- Investment banking

- Asset sales and trading

- Equity research

Skills and attributes you need for sell-side analysis include:

- Excel skills

- Industry research

- Financial modelling

- Pitching

- Ability to win new business

- Closing deals

Opportunities for advancement (Financial Analyst career path)

As a Financial Analyst, you can work in various capacities in an organisation. The Financial Analyst career path usually starts in a junior analyst role and continues into a senior analyst role.

- Junior analysts do more of the data gathering and spreadsheet management

- Senior analysts are concerned with weightier matters of supporting investment decisions and interfacing with management and investors.

Alternative careers

Financial Analyst is one of many types of business jobs. The below jobs represent the best alternative careers, with a similar degree and skillset as a Financial Analyst.

These jobs include:

- Market research analyst

- Operations research analyst

- Financial manager

- Management analyst

- Business operations manager

- Statistician

- Accountant

- Loan Officer

Steps to Becoming a Financial Analyst

You need to take some steps to qualify and start working as a Financial Analyst. Listed below are these steps (how to be a financial analyst):

Step 1: Earn a Bachelor’s Degree

To become a Financial Analyst, you need relevant tertiary training.

To land a Financial Analyst role, you need to earn at least a bachelor's degree. The best degree for financial analysis would be business, finance, accounting, or statistics.

Employers generally prefer candidates who have more than the minimum requirements. So, industry-specific certifications or higher degrees like a master's in finance or an MBA are excellent Financial Analyst qualifications.

Step 2: Sharpen your skills

Certain skills are essential to succeed as a Financial Analyst, and honing those skills is important.

You may want to gain proficiency in spreadsheet applications and data management tools like Microsoft Excel, Access, and SQL.

Step 3: Complete an Internship and other activities

An internship is a necessity if you’re to qualify as a Financial Analyst. It’s no secret that theoretical knowledge differs from hands-on experience.

More often than not, employers look for experience in addition to theoretical knowledge. While education gives you theoretical knowledge, it is an internship that gives you the experience that employers also need.

An internship allows you to apply the knowledge you acquired in school in the real world. As an intern, you will conduct research, evaluate financial data, develop models, etc. You'll also get to sharpen your skills.

Step 4: Find a Job

If you have relevant education and have acquired hands-on experience via an internship, the next step is to find a Financial Analyst job.

If the big job does not come right away, you may consider taking a position at a smaller company to gain valuable experience. You could also consider working as a volunteer at a smaller company.

Financial Analyst Interview Questions

Typical Financial Analyst interviews will include both technical and behavioural questions.

Technical questions include:

- What do you understand by financial modelling?

- What financial modelling tools do you use?

- Can you describe the cash flow statement?

- What is working capital, and what are the different types?

- What are the different types of financial statements?

- What is NPV, and what is it used for?

- Why are dividends not a part of the income statement?

- Explain solvency to me if I have no financial experience

Behavioural questions include:

- Why do you want to be a Financial Analyst?

- Why do you want to work for our organisation?

- What do you consider your biggest weakness, and how does this affect your work?

- Do you prefer working alone or in a team?

FAQ’s / Resources

What are the top 3 skills for a Financial Analyst?

The required skill set of a Financial Analyst starts with data gathering skills and includes analytical skills, critical thinking skills, communication skills, etc. While every skill is important, the top 3 skills would be:

- Research skills

- Analytical skills

- Financial modelling skills

Which degree is best for a Financial Analyst?

The minimum educational requirement to be a Financial Analyst is usually a bachelor's degree in business, finance, or accounting.

However, employers often desire higher degrees. So, the best Financial Analyst qualifications include a master's degree in business or finance, an MBA, or a finance (or accounting) certification.

How hard is it to be a Financial Analyst?

Becoming a Financial Analyst is not easy. It starts with obtaining a college degree. Then you may need to take courses to hone in on certain skills. You may also need to intern with a firm to gain hands-on experience.

After landing the job, being a Financial Analyst is also not easy. The position is complex and usually comes with heavy workloads that negatively affect the work-life balance. The Financial Analyst will have to work with different types of financial data (both internal and external). It usually takes a lot of time and effort to gather, organise, analyse, and interpret complex data sets.

Looking to break into one of the most highly-coveted industries internationally? Try one of our many helpful courses. From Financial Modelling to Data Analytics, Nexacu has you covered both in-person and remote.